-

Home

-

Publications and submissions

-

Reports

-

EWON Insights

-

EWON Insights Jan-Mar 2022

- Energy complaints and case studies

Energy complaints and case studies

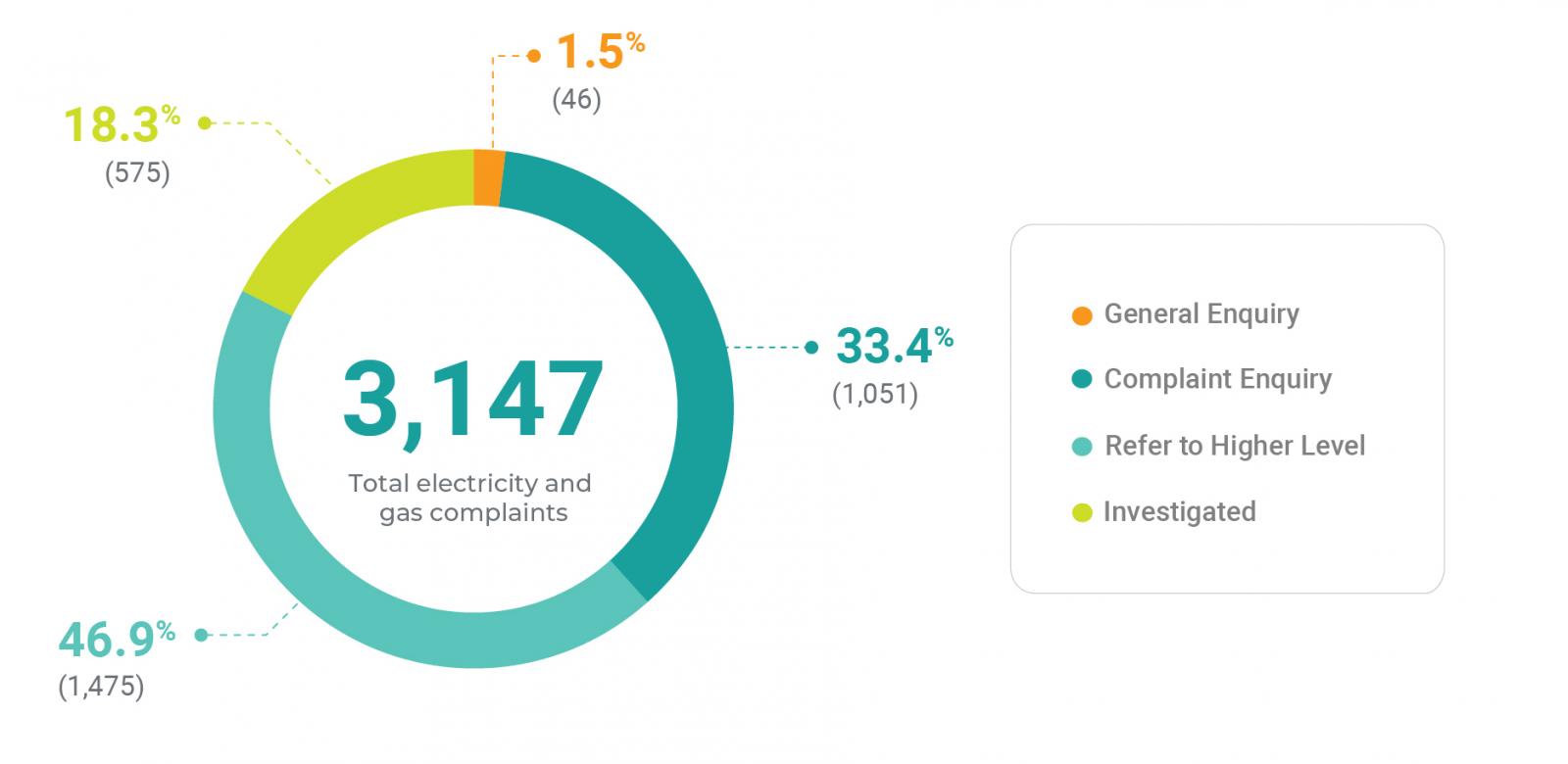

Table 4 – Energy complaint breakdown January - March 2022

| Complaint type | Number of complaints | % total energy complaints |

|---|---|---|

| General enquiry | 46 | 1.5% |

| Complaint enquiry | 1,051 | 33.4% |

| Refer to higher level | 1,475 | 46.9% |

| Investigated | 575 | 18.3% |

| Total | 3,147 | 100% |

NSW Review of the Energy Accounts Payment Assistance Scheme

The NSW Government’s Energy Accounts Payment Assistance (EAPA) scheme helps people who are having difficulty paying their household energy bill due to a short-term financial crisis or emergency. The scheme is delivered by over 200 non-government organisations and the Service NSW EAPA Assessment Team. A household is eligible for up to $300 for each of electricity and gas per financial year, and EAPA providers have some discretion to give a higher amount in exceptional circumstances.

The Department of Planning and Environment (DPE) is currently reviewing the EAPA scheme to ensure it remains fit for purpose. This review is timely as the past two years of living with the impact of COVID-19 have brought customer affordability issues into the spotlight.

Issues we have identified from complaints that we will be raising in the review include:

- consideration of assistance for customers who are not currently able to access EAPA, such as customers needing help with debts on closed accounts and customers living in embedded networks

- the need for a different approach to assist customers experiencing long-term, entrenched financial difficulties rather than short-term crisis, including a possible greater role for retailers in assigning EAPA

- other help customers seeking EAPA typically need and how best to provide that assistance.

The complaints below illustrate some of these issues.

Case Study: Customer who couldn’t pay energy bills has limited options once her accounts are closed

A customer contacted EWON in February 2022 after receiving a disconnection warning for an outstanding electricity balance. She had been on parental leave for four months and her partner, a casual worker, was on sick leave. Due to issues with her parental leave payments, the couple had been living off savings and credit cards. She contacted her retailer to advise that they were experiencing financial difficulties but felt that the retailer did not provide any assistance beyond referrals to seek EAPA vouchers.

EWON’s review found a balance of $650 owing for electricity and $350 owing for gas. The balances had accumulated over only two billing periods, as previously bills were always paid in full by the due date. The customer had never previously required a payment plan and EAPA had never been applied to either account. The retailer offered to establish payment plans for both accounts under its customer assistance program and encouraged the customer to obtain EAPA to reduce the balances.

During our investigation, the customer advised they had moved out of the supply address to her parents due to their financial difficulties. The customer would be closing the accounts, so EAPA would not be available and they would be ineligible for the customer assistance program. The customer agreed to contact the retailer once the final bills for electricity and gas were issued to discuss payment arrangement options. The retailer confirmed that it would take the customer’s circumstances into account in reviewing payment options. The customer was referred to free financial counselling and invited to return to EWON if she required further assistance after receiving the final bills.

Case Study: Embedded network customer disconnected and unable to seek EAPA assistance

A customer living in an embedded network contacted EWON in February 2022 because his electricity supply had been disconnected for non-payment. He lived alone and had been unable to work for some time because of an injury and lack of employment opportunities due to COVID-19 restrictions. Though he had since returned to work, he anticipated that his finances would be unstable for some time. He contacted the embedded network provider and offered to pay $50 per fortnight, but it would not reconnect his supply unless he paid the full balance of about $1,500. The customer thought he had previously received $200 worth of EAPA vouchers.

EWON’s review indicated that there had been no payments made to the customer’s account since it commenced in 2020 and minimal engagement from the customer. The retailer had complied with the relevant requirements before disconnecting the customer’s electricity supply. The embedded network provider confirmed that EAPA was not applicable to its sites, so it was unclear why the customer considered he had received $200 in EAPA vouchers.

EWON and the embedded network provider agreed it was reasonable to consider the customer’s financial circumstances, including the fact that he did not have access to assistance like EAPA. After the customer made an upfront payment of $100, the embedded network provider agreed to reconnect the electricity supply. The provider also advised it would accept a payment plan of $50 per fortnight, to be reassessed when the customer’s circumstances changed after a longer period of employment. EWON referred the customer to free financial counselling and highlighted the importance of remaining engaged with the embedded network provider.

Case Study: Multicultural community agency refers customer to EWON’s outreach program and provides EAPA vouchers

A multicultural community agency referred a customer to EWON in February 2022 through our outreach program. The customer was in his 60s, lived alone in a social housing property, had significant health issues that incurred medical bills, and received a fixed Centrelink income. EWON used an interpreter when speaking with the customer on the phone as English was his second language.

The customer had received a bill for over $1,000 for the period July 2021 to October 2021, which included arrears brought forward from previous bills. He was experiencing financial difficulties and worried that his bills seemed high for one person.

EWON’s review found that the customer’s bills were based on actual meter reads and were usually under $150 per quarter, except in winter when they increased to over $300. This was in line with the customer’s advice that he used heating in winter. The customer received the NSW Government Low Income Household Rebate and was on the best available market plan. The balance of $1,000 had accumulated over multiple years during which the customer’s payments did not quite cover ongoing bills. The customer had also received EAPA on multiple occasions but last received vouchers in December 2020.

The customer agreed to contact the retailer’s customer assistance team to establish a payment plan of $30 per fortnight, which he confirmed was affordable. During EWON’s review, the multicultural community agency also provided the customer with $300 worth of EAPA vouchers.

Two-day switching

Customers can now switch retailers in as little as two business days. Previously, customers with manually read meters had to wait up to three months until their next scheduled meter read, while customers with remotely read electricity meters could switch more quickly as their meter data is remotely accessible.

On 1 October 2021, changes to rules and procedures came into effect to bring switching timeframes in line with advances in the energy market. These changes enable, but do not guarantee, switching within two business days for all customers by:

- removing the option for retailers to choose the next scheduled meter read as the transfer date in most circumstances

- expanding the timeframe to use a past actual meter read for manually read meters from 10 to 65 business days (the limit for remotely read meters remains 10 business days)

- making it easier for retailers to arrange a transfer while still within the 10-business day cooling off period

- making it easier to arrange a transfer reversal when a customer exercises their cooling off rights

- allowing estimated meter reads to be used for transfers for manually read meters

- limiting the opportunity for a current retailer to object to a pending transfer

Retailers and market participants are expected to develop rigorous business-to-business practices over time to address any problems that arise from the changes. The following complaints illustrate some of the issues that have emerged since the changes came into effect, including:

- customer uncertainty about the relationship between the contract start date and date of transfer

- customers being transferred as at a past date or on an estimated meter read who report that they were not clearly informed this would occur

- customers wishing to withdraw explicit, informed consent or exercise their cooling off rights once they realise a transfer has occurred as at a past date or based on an estimated meter read

- customers thinking they have been billed for the same period twice, by both the previous retailer and new retailer

- customers being switched as at a past date and being uncertain whether this impacts the starting point of the cooling off period

- customer and retailer confusion about whether the customer should contact the previous or new retailer to dispute an estimated meter read

- complications for customers who have manually read interval meters

Case Study: Customer unhappy her electricity billing rights were switched

A customer with a manually read meter agreed to switch her electricity account to a new retailer in December 2021. She expected the transfer to happen at a future date, but realised it had happened at a past date when she received her final bill. The transfer date made her billing from her previous retailer confusing, and she might not have transferred if she had known this would happen.

EWON’s review found that the sales call with the customer took place on 8 December 2021 and the retailer sent her the market contract on 10 December 2021. The transfer was completed on 26 December 2021, after the cooling off period had ended, and the effective date was 29 October 2021, the most recent actual meter read date.

EWON listened to the sales call and found that the sales agent advised the customer that the transfer could be based on a past meter read or an estimated meter read. This was also covered in the retailer’s market contract terms and conditions.

The customer’s market contract stated that the contract start date was 10 December 2021 but did not specify that the date of transfer would be 29 October 2021. This may have given her the opportunity to exercise her cooling off rights if she did not wish to transfer as at a past date. EWON queried whether this fully complied with requirements under Rule 64 of the National Electricity Retail Rules for retailers to provide customers with information about a commencement date. The retailer considered the inclusion of the contract start date met the definition of a commencement date, and that there was general information in its terms and conditions advising that the supply start date would be the date that the customer’s assigned meter identifier was transferred.

EWON advised the retailer that while providing general information in the sales call and market contract terms and conditions appeared technically compliant, it did not meet the customer’s expectations of clear, specific information about the transfer process.

The customer switched away from the retailer during EWON’s investigation. The retailer applied all missed discounts plus a $50 customer service gesture to her closed electricity account, and the customer agreed to contact the retailer to discuss a payment arrangement for the final balance of $520.

Case Study: Customer disputes final electricity bill from previous retailer

A customer with a manually read meter switched to a new retailer in January 2022, and the transfer was based on an estimated meter read. He received a final electricity bill of $900 from his previous retailer, which he considered high. The estimated final meter read on the bill was inconsistent with the meter read on his physical meter, and there was such a large discrepancy between the two that the retailer declined to accept a customer meter read. Although the new retailer had arranged the transfer on an estimated read, the customer thought the previous retailer should address his complaint as he was disputing its billing. He could not dispute the start read from his new retailer, as he had not yet received his first bill from them. The customer confirmed that his property had a history of estimated meter reads due to access issues.

The previous retailer and EWON liaised with the customer and distributor to arrange a special meter reading. The retailer then adjusted the customer’s final bill based on the special meter read, reducing the bill from $900 to $500. EWON’s review found that the adjusted final meter read was in line with customer’s meter reads.

To help resolve the complaint, the previous retailer offered to further reduce the bill to $350 in line with the customer’s advice that he considered his normal bills to be about $400 maximum. The customer accepted the offer and agreed to contact the retailer to discuss a payment arrangement for the reduced final balance of $350. EWON provided information to the customer about his obligations to provide meter access and advised him to discuss options such as providing customer reads or installing a remotely read meter with his new retailer.

Case Study: Business customer disputes final estimated bill following a transfer

A customer with a manually read interval meter arranged for the parent company of his business to take over his electricity account in October 2021. The parent company established an account with a different retailer and the customer received a final electricity bill for $3,000 based on estimated interval meter data. He considered the bill too high as the business was shut down for most of the billing period due to COVID-19 restrictions. As the meter was a manually read interval meter, the customer could not provide a customer meter read to help progress the complaint. The retailer no longer held the billing rights and the account with the new retailer was not in the customer’s name, which made it harder for the distributor to attend and download actual data.

EWON’s review of the interval data for a two-year period indicated that data for June to October 2021 was estimated in line with actual data for the same period the year before when the business had been operating. EWON raised with the retailer that it may be fairer and more reasonable to compare the disputed estimated data with the much lower actual meter data for the period from March to June 2020, when the original COVID-19 stay-at-home orders were in place and the business was not operating. The retailer agreed and offered to apply a credit of $2,200 to bring the disputed estimated usage for the period June to October 2021 closer in line with actual usage for the period March to June 2020. The customer accepted the offer and agreed to contact the retailer to discuss a payment arrangement for the reduced final balance of $800.